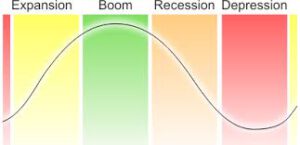

Long before the days of the Virus Lock Down Quarantines and our current Socialist Revolution, economists spent almost 150 years attempting to understand, explain, and navigate what is commonly known today as the Business Cycle.

Long before the days of the Virus Lock Down Quarantines and our current Socialist Revolution, economists spent almost 150 years attempting to understand, explain, and navigate what is commonly known today as the Business Cycle.

The concepts of inflation and deflation are widely used among all disciplines of economic thought, including the Austrians, Monetarists, Keynesians, and shockingly even the Marxists. Ask China. Although each discipline disagrees on the causes and solutions for inflation and deflation, all acknowledge they exist.

Understanding the concept of the business cycle is very useful, but perhaps even more useful than understanding the business cycle, is understanding how different assets classes and sectors react to the business cycle, depending where we are in the cycle.

If you walk into your local financial advisors’ office, they will almost certainly assure you that there are only two asset classes, equities and bonds, and that the wisest thing you can do is divide your portfolio 70/30 or 60/40 between the two classes, depending on your “risk tolerance.”

During linear bull runs and bubbles, 60/40 and 70/30 work out just great. But during crashes, debt deflation, recessions, and depressions, they shockingly do not. The plot also thickens when you find out that there are more than just two assets classes.

It is not by mistake that CNBC has you watching the DOW and S&P all day.

It is not by mistake that CNBC has you watching the DOW and S&P all day.

What is occurring during an equities “bull run” is you are getting roughly a 5-15% return annually until the 40-70% crash eventually comes. Your financial advisor will almost certainly tell you during this crash that it’s “irrelevant” if you are a long term investor, and depending if they’ve attended investment conferences in Omaha, NE, they may or may not play a ukulele.

There are indeed numerous asset classes, many of which perform incredibly well during crashes, from trading volatility, to shorting, to holding cash. They know this; they just don’t want you to know this. If retail investors knew the truth, that these people usually simply “follow the FED,” it would reveal that they don’t really know what they are talking about, and the whole thing is a just a Central Bank confidence game.

Look at the Forex markets. Look at gold, bond yields, volatility, dollar index, oil. Not just in the current market, but in all the economic shocks of the last 25 years.

The other asset classes tell you a much different story than looking at the DOW all day. Most importantly, watch how they all react during different points in the business cycle. It’s almost a symphony.

Gus Demos is the managing partner and co-founder of Perpetual Assets, America’s first Cryptocurrency and Precious Metals Dealer specializing in Retirement Accounts that offer clients complete control over their LLC IRA, and gives them the flexibility to invest across numerous asset classes with ease. Perpetual Assets’ cryptocurrency trade desk offers clients the fastest onboarding process in the industry, and the convenience of our customer service team getting you through all the KYC and AML processes. Their Metals Cards offer clients the opportunity to own physical gold and silver safely segregated and insured in a vault, with the ability to liquidate it in real time using a Visa debit card.

Gus Demos is the managing partner and co-founder of Perpetual Assets, America’s first Cryptocurrency and Precious Metals Dealer specializing in Retirement Accounts that offer clients complete control over their LLC IRA, and gives them the flexibility to invest across numerous asset classes with ease. Perpetual Assets’ cryptocurrency trade desk offers clients the fastest onboarding process in the industry, and the convenience of our customer service team getting you through all the KYC and AML processes. Their Metals Cards offer clients the opportunity to own physical gold and silver safely segregated and insured in a vault, with the ability to liquidate it in real time using a Visa debit card.

Gus will be speaking at FreedomFest, “the world’s largest gathering of free minds,” Caesars Palace Las Vegas, July 13-16.