The government can move in at any moment; however, they can’t censor, devalue or steal math.

History repeats itself. Although the world is experiencing major global unrest, it is also true that there is “nothing new under the sun” – regimes change, power structures shift, and the fourth turning is upon us. It is indisputable that some make it out on top throughout each time of contention while others lose everything. With technology at our fingertips, information is available and those who take the time to learn can set themselves up to make it out of the coming crises prosperously.

Many have heard about bitcoin and its parabolic increase in price, yet they don’t understand its full value proposition because one must shift the paradigm to understand. Technology has allowed for complex concepts to be implemented via software code. In the case of bitcoin, the “good or service” being disrupted is money or the transfer of value. With peer-to-peer exchange being the ultimate goal of bitcoin, we are seeing technology that effectively cuts out middle-men while allowing unbanked individuals access to participate in the global economy. The bitcoin network can be accessed with just a cellphone and a WiFi signal; it is not tied to a single country’s economy; there is an undisputable limited supply; and you don’t have to purchase a full bitcoin. One “satoshi” is the smallest unit of measure and goes to 8 decimal places (0.00000001).

Bitcoin’s history

As a decentralized, cryptographic digital currency, bitcoin is an invention made from decades of cryptographers working on creating money for transacting purely online. Since nearly the inception of the internet (an example of a paradigm shift), the concept of secure digital value transfer has been worked on by software developers globally. In Oct 2008, Bitcoin’s white paper was released and in January 2009, Bitcoin’s first block was mined, coinciding with the Times front-page headline “Chancellor on brink of second bailout for banks.” It is clear that bitcoin was created because the people need a better form of money, one that could not be manipulated by central banksters.

With no central authority, bitcoin was initially “mined” by tech enthusiasts using PC power and given away for free on internet faucets. Fast forward to today and there are hundreds of thousands of computers around the world dedicating their power to “mining” new bitcoins and upholding the integrity of the system.

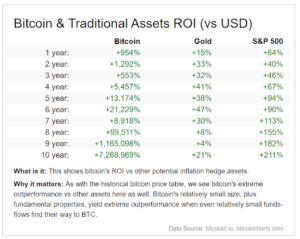

The market capitalization of bitcoin is still less than some publicly traded companies, meaning – you’re still early. In its growth phase, bitcoin has performed like a tech stock. In its mature phase, we will see it behave more like a store of value. If you understand Austrian economics, there is no such thing as intrinsic value, because value is subjective. In the case of bitcoin, its value is being realized as the stability of economies is threatened and as people understand its position as digital gold. Thus far, in 2020, bitcoin has heavily outperformed every other asset class and its non-sovereign nature has proven it is completely uncorrelated to the dollar.

Adoption has snowballed in recent months. Companies such as PayPal, Cash App, Robinhood and Fidelity have bitcoin as part of their suite of services. The oldest bank in America, BNY Mellon, is now able to store bitcoin in custody. Companies like Microstrategy and Tesla have put bitcoin on their balance sheets instead of cash, and Visa is building infrastructure to support bitcoin payments.

The Value Proposition

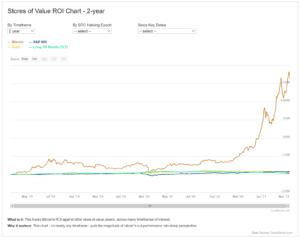

Source: casebitcoin.com

Taking a look at the chart above, we see bitcoin significantly outperform gold, the S&P 500, and US bonds. But why the rapid price increase during a year of unrest and record unemployment? Even over proven stores of value like gold? Below are a few traits of bitcoin to make clear:

- Bitcoin is Digital Gold. It is not issued by governments and it is limited in supply. Unlike gold, the exact quantity in circulation, digital location, and rate by which new bitcoins enter the system can be measured.

- Bitcoin cannot be confiscated. There is no back door to access your funds. As long as you know your “seed phrase” you can move freely with your wealth intact – a virtual possibility that is physically impossible with gold or cash. It is the separation of money and state.

- Bitcoin has a limited supply. There will only ever be 21 million bitcoin. In order to be “good money,” an asset must be: fungible, non-consumable, portable, durable, highly divisible, secure, easy to transact, scarce, and widely accepted. Bitcoin is the highest rated among many of these traits. It is sound monetary principles written into software code. It is a free market in global money.

- Bitcoin is a peaceful exit from the current financial system. Economic problems are magnified due to arbitrary monetary policy decisions made by flawed humans. Bitcoin is software code, and its incorruptible, open-source nature makes it impossible to make changes to the currencies underlying Austrian economics.

- Bitcoin is transparent. We no longer have to trust humans. We can verify where and how funds are moving in real-time by monitoring the blockchain.

- No country is immune to hyperinflation and social unrest. There is currently a zero percent reserve rate requirement for US banks, and the federal reserve balance sheet has expanded by 75+% in 2020. With significant distrust in the political process, individuals have become mindful of where their value is stored. Although bitcoin is not widely used for transactions in the United States, citizens from countries like Venezuela and Zimbabwe use it for survival.

- Bitcoin is an option, and people will pay for options, especially those that4 allow you to be your own Swiss bank account.

- Bitcoin is decentralized, making it infinitely more secure than even bank-grade security. At its current hash rate, it is mathematically impossible to unilaterally influence the system in a negative way.

- Bitcoin is Censorship-Resistant, meaning nobody can shut you out of participating. Imagine what confidence this provides for innocent humans living in sanctioned countries. Imagine what assurance this provides for liberty-minded individuals who challenge the mainstream narrative and have been censored by the financial system because of it.

- Bitcoin is math. In a technological age, our archaic banking system is due for an upgrade. Simply put, bitcoin is an online ledger whose accounting is done by computers running math problems – eliminating human error. Anyone with a bit of research can dedicate computing power to securing the network.

- All other asset classes are denominated in fiat currency. The issue we face today is that fiat has lost significant purchasing power since we removed ourselves from the gold standard.

In the same way that the internet changed the distribution and flow of information, bitcoin will change money and value. Digital currencies were made for such a time as this, a safe haven for those who appreciate personal responsibility and take the time to learn how to preserve their wealth for future generations. Paradigm shifts create prosperity. If 2020 hasn’t shifted enough of your life, the coming months will not disappoint in proving the importance of diversification.

For more information on how to safely buy bitcoin, please visit me at bankoferyka.com where I have helped hundreds of people become their own bank by owning bitcoin. Setup a free 20-minute strategy session with me to assess your needs for exposure to the best performing asset class in the past five years.

As the Venture Director at a Digital Asset Hedge Fund, Eryka is well versed in bitcoin’s technology. In 2019, she co founded Blockchain Center Miami with a goal of making her city the crypto capital of the Americas. Over the years, Eryka has taught hundreds of people how to safely navigate the cryptocurrency space. Eryka sits on the executive board of the Florida Blockchain Business Association and writes a bitcoin column for Escape Artist Insiders Magazine. She graduated from Embry-Riddle Aeronautical University in 2015 with a pilot’s license and Bachelor of Science in Aeronautics. The ability for blockchain to increase transparency, reduce corruption, and eliminate human error drove Eryka to leave corporate America. She is now focused on bringing technical and economic education on digital assets to the masses. Her affinity for bitcoin stems from an appreciation for sound money and honest reporting. As a teenager, she was a delegate in Washington State for the Ron Paul campaign.

As the Venture Director at a Digital Asset Hedge Fund, Eryka is well versed in bitcoin’s technology. In 2019, she co founded Blockchain Center Miami with a goal of making her city the crypto capital of the Americas. Over the years, Eryka has taught hundreds of people how to safely navigate the cryptocurrency space. Eryka sits on the executive board of the Florida Blockchain Business Association and writes a bitcoin column for Escape Artist Insiders Magazine. She graduated from Embry-Riddle Aeronautical University in 2015 with a pilot’s license and Bachelor of Science in Aeronautics. The ability for blockchain to increase transparency, reduce corruption, and eliminate human error drove Eryka to leave corporate America. She is now focused on bringing technical and economic education on digital assets to the masses. Her affinity for bitcoin stems from an appreciation for sound money and honest reporting. As a teenager, she was a delegate in Washington State for the Ron Paul campaign.

Eryka will be speaking at FreedomFest July 21-24 at the Rushmore Civic Center in Rapid City, South Dakota.