Stock market returns over the past 15 years have been unprecedented, fueled by trillions of dollars in free money, courtesy of quantitative easing by the Federal Reserve. However, market conditions have changed, just as they did in 2007 and 2008. The effects of rising interest rates, high inflation, increased spending by government and the shutdown of quantitative easing are forecast to be with us to the end of this decade. All of these factors negatively affect corporate returns and make the cost of doing business more expensive. That affects stock prices negatively. Many banks and brokers are budgeting for effective returns of 4 – 5% per year through 2030. And increased volatility will result in even greater uncertainty going forward. There has never been a better time or reason for strategic diversification as protection against the devaluation of your hard earned asset base! And when that diversity offers the ultimate in privacy and the promise of continued double digit yearly growth, it makes a prudent case for allocating a percentage of one’s long term asset base into select hard assets.

FORECAST FOR GOLD AS AN ASSET

According to the World Gold Council, only 22% of all gold ever mined is held as private investment. Industrial uses for gold in addition to jewelry manufacturing historically have accounted for almost 50% of all gold ever mined. The total supply of gold mined each year leaves investors in the minority and without the ability to influence the market price with the single exception of speculation. “Margin buying” is another term for speculation! Speculation will move a market up or down in the short term only. If protection of assets is the reason for buying gold, the volatility from speculation surrounding gold makes it not much better (or worse) than stocks over the medium to long term. Having said this, like stocks, there should be a place in everyone’s wealth accumulation strategy for hard asset metals. The key is to have a diversified strategy that balances irsk and reward with safety spread over a variety of strategic assets.

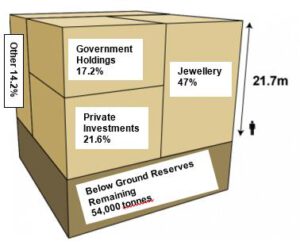

TOTAL GOLD MINED OVER THE PAST CENTURY BY USAGE.

Total above-ground stocks (end-2019): 197,576 tonnes

- Jewellery: 47.0% )

- Private investment: 21.6% ) Mined to 2022

- Government Holdings: 17.2% ) 197,576 tonnes

- Other: 14.2% ) (78.5%)

- Known below ground reservesremaining: 54,000 tonnes (21.5%)

Source: Metals Focus; GFMS, Thomson Reuters, US Geological Survey, World Gold Council

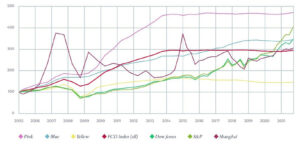

COMPARATIVE PERFORMANCE HARD ASSETS VS. STOCK MARKET 2005 – 2021

Hard assets such as select natural colored diamonds, untreated gemstones and vintage watches have a decades-old record of performance that rivals the performance of the stock market, precious metals (including gold and silver) and real estate over the same period.

According to independent research conducted by Citrin Cooperman & Company LLP, on behalf of the Fancy Colored Diamond Research Institute, all colors of natural colored diamonds have shown double-digit average yearly growth over the past 15 years. This is consistent with returns from the Dow Jones Industrial Average during the same 15-year period. However, graphs are only averages! There are stocks that have outperformed the market, and there are specific colors of natural colored diamonds that have outperformed the market average by more than 10% per year. Both have rewarded ownership on a consistent basis. However, there are stark differences regarding ownership. Unlike stocks, gold or real estate, which are all forecast to return single-digit returns over the next 6 – 8 years, hard assets will remain as a double-digit growth option. Double-digit growth and privacy of ownership are two compelling reasons to investigate hard assets as a wealth accumulation vehicle.

STOCK MARKET PERFORMANCE 2005 – 2021 COMPARED TO ALL COLORS OF NATURAL COLORED DIAMONDS PLUS INDIVIDUAL PINK, BLUE, YELLOW

Education is the key to strategic wealth accumulation. To find out more about hard assets and to properly evaluate them as a potential diversification tool, join us at FreedomFest July 13-16 at the Mirage Hotel in Las Vegas, and visit us at Booth # 429 & 528. Privacy, historic double digit returns, liquidity and a worldwide market are all sound reasons to investigate the potential of hard assets.