We’ve all been there. Bowled over at first sight; eye-catching, known world-wide, and the subject of entire books. What a package!

But as your acquaintance deepens you sense that something’s amiss… Maybe you’re not getting the straight story… And maybe you start looking around.

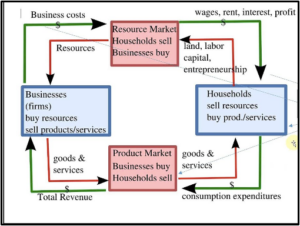

That was certainly the case for me. Like most people, the first economic supermodel I encountered was the Circular Flow Diagram. It checked all the boxes; it captured the big picture, was world renown, and on the first pages of every textbook. The big, wide world condensed into one tight little package.

That was certainly the case for me. Like most people, the first economic supermodel I encountered was the Circular Flow Diagram. It checked all the boxes; it captured the big picture, was world renown, and on the first pages of every textbook. The big, wide world condensed into one tight little package.

But over time I wondered…

Is production really instantaneous? Is capital just some constant, undifferentiated blob?

Do resources sit around on shelves somewhere, waiting to be purchased?

And where did this economy come from? Can we trace its origins, or did it just fall from the sky, homogenous capital ablaze? And hey! Did she just wink at Keynesianism? Even MMT? I thought my supermodel might be playing games on me. I decided to look around.

I’d seen Input/Output models in school. They obscured a lot of details and I always thought they smacked of voodoo.

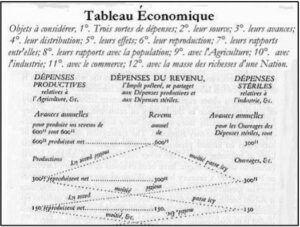

Similarly, the Physiocratic Tableau left me scratching my head.

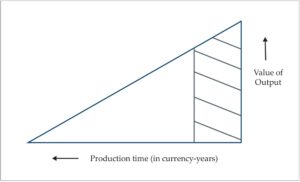

Hayek’s Triangle caught my eye. He tried to incorporate production, capital, and time in simple figures.

Hayek’s Triangle caught my eye. He tried to incorporate production, capital, and time in simple figures.

Hayek had the right factors in play, but no matter which way I turned his triangles I couldn’t find clear, unambiguous answers.

In the same vein as Hayek, Böhm-Bawerk wanted to reduce the land, labor, capital and time to simple geometric shapes. And again, I could see where he was trying to go but there were lots of loose ends. Could I explain concentric rings to a novice?

In the same vein as Hayek, Böhm-Bawerk wanted to reduce the land, labor, capital and time to simple geometric shapes. And again, I could see where he was trying to go but there were lots of loose ends. Could I explain concentric rings to a novice?

Both Böhm-Bawerk and Hayek understood the economy as a dynamic, ever-evolving dance between the factors of production and the wants of consumers. Unfortunately, they only had two-dimensional paper on which to express those thoughts.

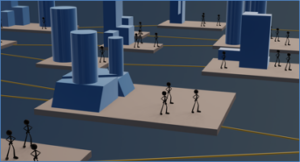

But by using 3D graphics, we’ve built a model that’s simple and realistic as well as comprehensive. We call it LinKē, and it’s the world’s next economic supermodel.

But by using 3D graphics, we’ve built a model that’s simple and realistic as well as comprehensive. We call it LinKē, and it’s the world’s next economic supermodel.

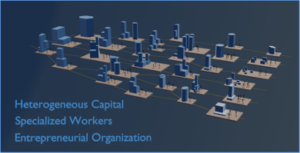

With LinKē we can visually illustrate the relationship between the factors of production and how they evolve over time.

Right before your eyes, you can see an economy evolve. You can see the business cycle happen in real time. You can see stepwise production.

Zooming in, we see that each business has specialized capital and workers to accomplish its particular task.

We have disaggregated “Labor” and “Capital” into specialized workers operating specialized tools.

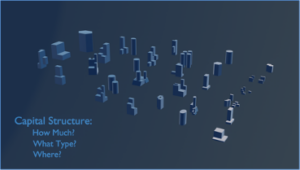

You can see the capital structure and how it’s driven over time by the price structure.

You can see the capital structure and how it’s driven over time by the price structure.

You can see the price structure develop as consumer desires are transmitted through the economy all the way back to natural resources.

Who could consider LinKē and then imagine that arbitrarily shifting capital around might be a good idea? Instead one wonders, “How does this amazing structure arise and what keeps it healthy?”

LinKē has many more tricks. Just as we illustrate the capital structure, we also clearly show the price structure. We see prices originating with consumer sales and then dynamically propagating back across the economy to natural resources. We also show how the price structure drives the capital structure over time.

What about government spending? In contrast to the consumer price discovery above, LinKē illustrates the lack of prices for tax-funded services and the resulting distortions of the market economy.

Want to see the business cycle? No problem! LinKē videos dynamically show the misallocation of capital into a given sector, along with the migration of workers to that sector. Then we see these workers become unemployed as the business cycle turns and businesses shrink during the recession.

And what about that “circular flow” of money? We layer in streams of money going countercurrent to the products and see the above mentioned price formation and price structure. Then we run the money through the banking system. LinKē illustrates traditional banking, fractional reserve banking, and central banking. In each case we turn various features on and off to highlight the ones of interest.

Note that LinKē starts with the structure of production and then later introduces money as an aide to production. Money is the lubricant in this machine – not the fuel!

See LinKē live at FreedomFest!

The static pictures above don’t do LinKē justice. To truly appreciate LinKē you need to see him in action. Click here for a quick demo. Or better still, we’ll be unveiling more LinKē features at FreedomFest , “the greatest libertarian show on earth,” July 13-16 at the Mirage Las Vegas Hotel. Drop by the Middle School MBA booth and see for yourself!

John Rock Foster is president of Middle School MBA, the fastest, youngest, and most rigorous economics curriculum on the planet. Middle School MBA streams into any classroom, giving its teacher a new superpower overnight. Visit MiddleSchoolMBA.com

John Rock Foster is president of Middle School MBA, the fastest, youngest, and most rigorous economics curriculum on the planet. Middle School MBA streams into any classroom, giving its teacher a new superpower overnight. Visit MiddleSchoolMBA.com

John developed LinKē to augment kids’ understanding of economics but finds it useful for everyone. You can email him at [email protected].