It was the reading of his book that made an ‘economist’ out of me. — Ludwig von Mises

I found it such a fascinating book, so satisfying. — Friedrich Hayek

No book since David Ricardo’s Principles has had such a great influence on the development of economics as… — Knut Wicksell

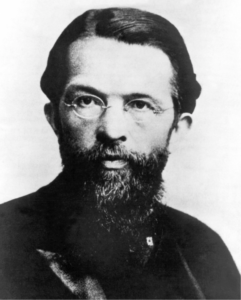

The revolutionary book that these three writers praised is Carl Menger’s Grundsätze der Volkswirtschaftslehre, published in 1871 in Vienna, Austria. It was not translated into English as Principles of Economics until 1950.

The revolutionary book that these three writers praised is Carl Menger’s Grundsätze der Volkswirtschaftslehre, published in 1871 in Vienna, Austria. It was not translated into English as Principles of Economics until 1950.

This was the book through which the Austrian School was born and made economics a real science. After Menger wrote his magnum opus, he became a distinguished professor at the University of Vienna. For several years he taught the crown prince of Austria and was a man of great influence. By the turn of the century, the Austrians were considered the most dominant school in economics and were the first to take on the Marxists.

This year marks the sesquicentennial (150th anniversary) of the Austrian School of Economics, beginning with the 1871 publication of Menger’s revolutionary Principles of Economics.

And today, February 26, 1921, is the 100th anniversary of Menger’s death. He lived to the grand old age of 81. As Lin Yutang, the great Chinese libertarian philosopher, would say, “He was favored of heaven.”

Why should we honor him?

Carl Menger (1840-1921) and his followers enhanced Adam Smith’s positive vision of the capitalist system. In many ways, Menger was a revolutionary discoverer of both macroeconomics (through his time structure of production) and microeconomics (subjective demand and marginal analysis).

Carl Menger (1840-1921) and his followers enhanced Adam Smith’s positive vision of the capitalist system. In many ways, Menger was a revolutionary discoverer of both macroeconomics (through his time structure of production) and microeconomics (subjective demand and marginal analysis).

He was the first economist to get it right on both counts, micro and macro.

Therefore, I conclude that Carl Menger deserves to be honored as the greatest economist who ever lived.

I dedicated my own book, The Structure of Production (New York University Press, 1990), to Menger. It was Menger who inspired my development of gross output (GO), a measure of spending at all stages of production that the government adopted in 2014.

Further, Menger was a financial reporter who covered the stock market in Vienna, and it was there that he discovered that prices of stocks and all goods and services are based on only a marginal number of buyers and sellers. Thus, he discovered the principle of marginal analysis that forms the basis of economic science today.

He also developed a better way to measure the standard of living in a country. The traditional approach was to calculate the average per capita wage or income level. But Menger took a different route — he looked at the quantity, quality and variety of goods and services bought by consumers to determine a person’s, or country’s, well-being.

I use this same approach when I teach economics to students, and it’s an eye-opener. For example, many economists claim that real wages for the average American have stagnated over the past 30 years.

Yet, if you look at the quantity, quality and variety of goods and services over the past 30 years, it is clear that almost everyone’s living standards has increased dramatically. From television sets to air conditioning to smart phones and the variety of foods, we are all better off, even if our income hasn’t changed much.

I also use the Austrian theory of the business cycle in my forecasts about the economy and the stock market, based on the works of Ludwig von Mises, Friedrich Hayek and other followers of Menger. They taught that easy-money policies are inflationary and lead to the boom-bust cycle in the economy and in the stock market. Right now we are enjoying the boom phase of the economic recovery, but soon there will be a day of reckoning when the stock market will fall to a more reasonable valuation. Using Menger’s work I am better equipped to foresee that change in direction.

Finally, Menger debunked the traditional view that money was the creation of the state. Most economists at the time thought that currencies such as the German mark and the British pound were inventions of the government to facilitate trade, create wealth, and finance public works.

However, Menger debunked this thesis. “Money is not the product of a legislative act,” he said. “The origin of money is entirely natural.” He showed that money began in the market place as specific commodities, especially gold and silver, that naturally developed into a medium of exchange because they were more durable, recognizable and stable. National currencies such as the pound sterling, the French franc and the U. S. dollar were nothing more the specific weights of gold or silver.

Celebrating the Austrian School of Economics

We are going to have a special session at FreedomFest about how investors can profit from the Austrian School of Economics, especially its business-cycle theory. If you want to get a head start, I suggest you obtain a copy of my book “A Viennese Waltz Down Wall Street: Austrian Economics for Investors” available for only $20 postpaid at www.skousenbooks.com.

Mark Skousen is the founder and producer of FreedomFest, “the world’s largest gathering of free minds,” meeting this year at the Rushmore Civic Center in South Dakota, where Governor Kristi Noem has kept businesses open throughout the pandemic. He is a Presidential Fellow at Chapman University and has written over 25 books on finance and economics.

Mark Skousen is the founder and producer of FreedomFest, “the world’s largest gathering of free minds,” meeting this year at the Rushmore Civic Center in South Dakota, where Governor Kristi Noem has kept businesses open throughout the pandemic. He is a Presidential Fellow at Chapman University and has written over 25 books on finance and economics.